Shares in Hims & Hers Health Inc have entered 2026 under renewed pressure, extending a period of volatility that began in the final quarter of last year. The US-based telehealth group, best known for its direct-to-consumer health subscriptions, has faced mounting investor caution linked to regulatory changes, legal tension within the pharmaceutical sector and intensifying competition in the lucrative weight-loss market.

For UK investors tracking global healthcare equities, the recent movement in Hims stock reflects a broader recalibration across digital health platforms that expanded rapidly during the pandemic but now operate in a more tightly scrutinised environment.

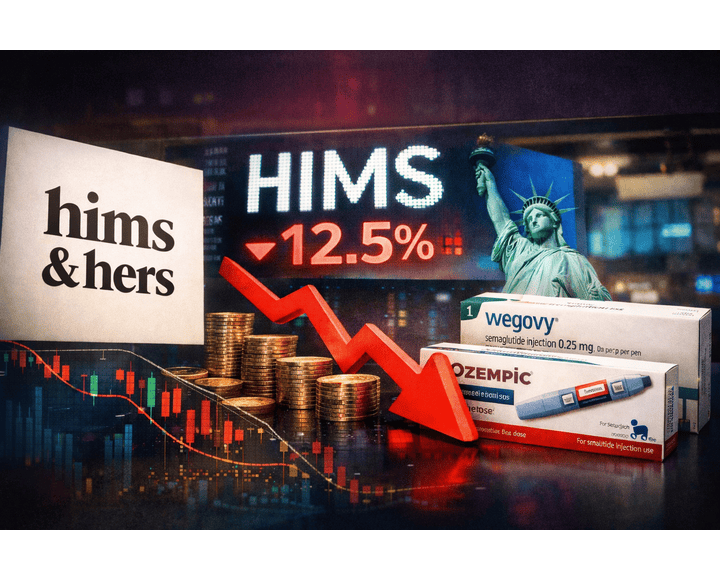

Recent Share Price Performance

Hims stock has experienced a noticeable retreat in early January trading, reversing some of the gains recorded during its 2025 expansion into obesity treatments. Market data show the shares falling across several consecutive sessions, with analysts attributing the slide to regulatory developments affecting compounded weight-loss drugs.

While volatility is not new for growth-focused healthcare companies, the current sell-off differs in tone. Investors appear to be weighing structural risks rather than reacting to short-term earnings fluctuations. Trading volumes have increased during declines, suggesting institutional repositioning rather than routine profit-taking.

The share price remains well above its post-listing lows but below peaks achieved when enthusiasm around GLP-1 therapies drove sector-wide optimism.

Why Is Hims Stock Falling?

The central issue concerns regulatory oversight in the United States. During shortages of popular GLP-1 medicines used to treat obesity and type 2 diabetes, certain telehealth platforms facilitated access to compounded versions prepared by licensed pharmacies. These alternatives became widely used when branded products were difficult to obtain.

However, the US Food and Drug Administration has signalled that supply shortages affecting key GLP-1 treatments have eased. Under US law, large-scale compounding is typically permitted only when approved medicines are unavailable. As supply normalises, regulators have indicated that emergency flexibility will not continue indefinitely.

This shift has implications for revenue models that relied on compounded treatments. Investors are concerned that tighter enforcement could restrict sales in one of the fastest-growing areas of Hims’ business.

Tensions with Established Drugmakers

Further pressure emerged following developments involving Novo Nordisk, the manufacturer of Wegovy. A previous commercial relationship between the pharmaceutical group and Hims did not continue, and public disagreements surfaced regarding marketing practices and distribution channels.

Although no formal enforcement action has been confirmed, the episode has heightened sensitivity around compliance and intellectual property issues. The broader pharmaceutical sector remains protective of branded treatments that command premium pricing and have undergone extensive clinical trials.

Competition in obesity treatments continues to intensify. Eli Lilly and other global manufacturers are advancing new formulations, including oral alternatives that may reshape prescribing patterns. As major drugmakers expand capacity and product pipelines, opportunities for alternative distribution models may narrow.

Business Fundamentals Remain Strong

Despite the share price decline, Hims & Hers has reported strong top-line growth. Recent quarterly results showed revenue rising sharply year on year, supported by expanding subscriber numbers and higher average order values.

The company’s model centres on subscription-based care, with online consultations connecting patients to licensed clinicians. Its portfolio spans dermatology, mental health, sexual health and preventive screening services, in addition to weight management.

Management has emphasised diversification as a strategic priority, arguing that the platform’s long-term value lies in its digital infrastructure and recurring revenue base rather than a single product category.

Subscriber growth remains a key performance indicator. Investors are closely watching retention rates, marketing efficiency and cost per acquisition, which influence margin sustainability.

Profitability and Cost Pressures

While revenue has grown, profitability remains under scrutiny. Like many digital health platforms, Hims invests heavily in marketing to attract new members. Advertising expenditure, platform development and fulfilment costs can weigh on operating margins.

The company has reported improvements in adjusted earnings metrics, yet net profitability remains sensitive to regulatory outcomes and product mix. Should certain high-demand treatments face tighter oversight, revenue composition may shift.

Markets have become less tolerant of prolonged cash burn in the higher interest rate environment that followed the post-pandemic stimulus era. Investors now prioritise durable earnings visibility over rapid expansion alone.

What Investors Are Watching in 2026

Several catalysts could shape Hims stock over the coming quarters. Regulatory clarity from US authorities would reduce uncertainty. Clear guidance from management on compliance strategy may reassure investors that growth plans align with evolving rules.

Quarterly earnings updates will also be closely examined. In particular, analysts will focus on revenue contribution from weight management compared with other service lines, as well as progress towards sustained profitability.

Competitive developments in the GLP-1 market remain another factor. Clinical trial data, pricing strategies and manufacturing updates from major pharmaceutical groups often influence sentiment across the sector.

For UK-based investors holding international healthcare shares through global funds or direct US listings, the situation underlines the importance of regulatory risk assessment when evaluating growth stocks.

Is Hims Stock a Long-Term Opportunity?

The long-term investment case hinges on whether Hims can maintain subscriber growth while adapting to a stricter regulatory landscape. Demand for accessible healthcare remains strong, particularly among younger consumers comfortable with digital consultations.

Telehealth adoption has become embedded in patient behaviour, and direct-to-consumer models continue to disrupt traditional care pathways. If Hims successfully broadens its product offering beyond weight management and improves operational efficiency, the company could retain investor confidence.

However, valuation sensitivity to regulatory headlines suggests continued volatility. For now, markets appear to be pricing in higher compliance risk and moderating growth expectations.

The Broader Significance

The story of Hims stock reflects more than company-specific challenges. It signals a maturing phase in digital healthcare, where rapid expansion meets regulatory reality. Companies that once benefited from supply shortages and emergency flexibility must now operate within tighter frameworks.

For investors, the episode serves as a reminder that innovation in healthcare carries both opportunity and oversight. Growth prospects remain present, but policy shifts can swiftly alter revenue assumptions.