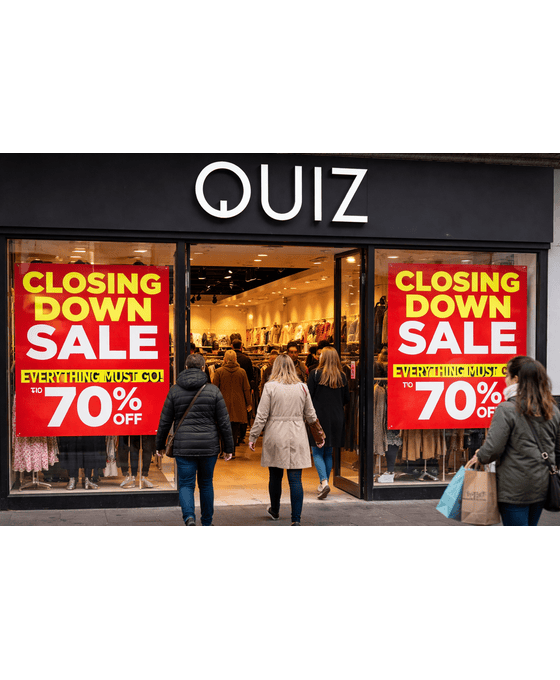

Fashion retailer Quiz Clothing has entered administration for the third time, underlining the continuing strain on mid-market brands operating on the UK high street. The Glasgow-based company confirmed that administrators were appointed earlier this year, following a prolonged period of weak trading and rising operating costs.

The move places further uncertainty over the future of the womenswear brand, which has traded for more than three decades and built a national presence through a mix of physical stores and online sales. While some stores are expected to continue trading during the administration process, the collapse represents another setback for a sector already grappling with structural change.

What has happened to Quiz Clothing

Quiz said the decision to appoint administrators came after efforts to stabilise the business failed to secure a sustainable recovery. Like many fashion retailers, the company has struggled with reduced consumer spending, higher costs and shifting shopping habits, particularly as customers increasingly favour online-only or discount retailers.

The administration marks the third such restructuring in recent years, highlighting the difficulty of maintaining profitability for mid-sized fashion chains that sit between fast-fashion giants and value-focused brands. Administrators have begun assessing the business with a view to protecting remaining operations where possible.

Impact on staff and operations

The latest collapse has resulted in job losses at the company’s head office and distribution operations, with affected employees informed as the insolvency process began. Store staff at a number of locations are expected to remain in post for now, as administrators seek to keep parts of the business trading while longer-term options are explored.

Quiz has continued to operate a reduced estate in recent years, relying more heavily on physical outlets and concessions following earlier restructurings. However, the brand’s online business has been wound down, signalling a significant contraction of its previous multi-channel model.

A familiar story on the UK high street

Quiz’s difficulties reflect broader challenges facing UK fashion retailers. Rising rents, business rates, energy costs and wage pressures have combined with weaker discretionary spending to squeeze margins, particularly during key trading periods such as Christmas.

The shift in consumer behaviour since the pandemic has further compounded these pressures. Footfall in many town and city centres remains below pre-pandemic levels, while competition from global online platforms has intensified. For brands like Quiz, which rely on occasionwear and trend-led fashion, these changes have proved especially difficult to navigate.

A brand with repeated restructurings

Founded in Scotland in 1993, Quiz grew rapidly during the 2000s and 2010s, expanding across the UK and overseas. The company listed on the London Stock Exchange in 2017, but its growth strategy was later undermined by changing market conditions and a slowdown in sales.

Previous administrations saw store closures, job losses and attempts to reset the business on a smaller scale. Despite these measures, Quiz has struggled to return to consistent profitability, making the latest insolvency another sign of the long-term pressures facing the brand.

What administration means

Administration is a formal insolvency process designed to give struggling companies breathing space from creditors while options are considered. These can include selling parts of the business, securing new investment, or closing unviable operations in an orderly manner.

For Quiz, administrators will assess whether parts of the retailer can be sold or restructured, while seeking to maximise returns for creditors. The process also determines how remaining employees are treated and whether any stores can continue trading on a longer-term basis.

Wider implications for retail

Quiz’s collapse adds to a growing list of fashion retailers that have entered administration or undergone major restructurings in recent years. Industry analysts have repeatedly warned that mid-market fashion remains one of the most exposed segments of the retail sector, particularly as costs rise faster than consumer demand.

The case has renewed calls from retail bodies for reforms to business rates and greater support for town centres, as well as investment in helping traditional retailers adapt to digital-first consumer behaviour.