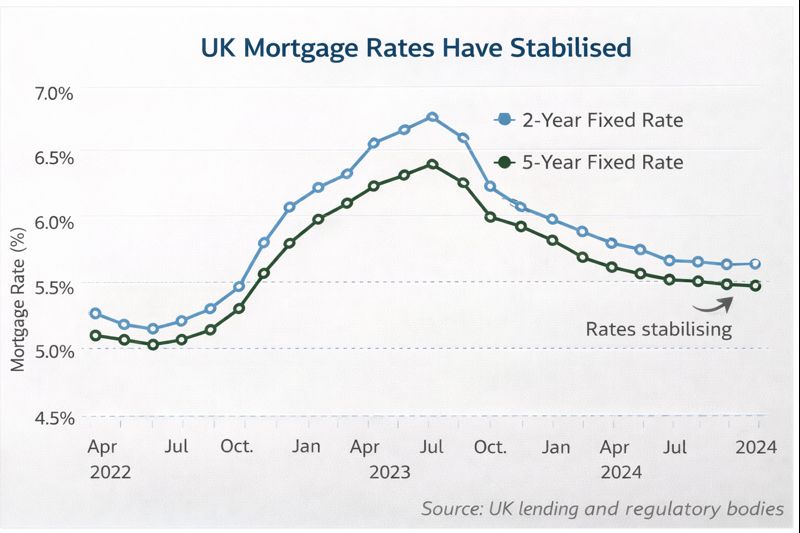

After several years of sharp movement, mortgage rates in the UK have entered a period of relative stability. While rates remain higher than the ultra-low levels seen in the late 2010s, recent data suggests that pricing has become more predictable, offering households greater clarity when making borrowing decisions.

This shift follows a prolonged period of adjustment in response to inflationary pressures and tighter monetary conditions. For both first-time buyers and existing borrowers, stability rather than rapid declines has become the defining feature of the current mortgage environment.

Where Mortgage Rates Are Settling

According to lending market data compiled by the Financial Conduct Authority, average fixed-rate mortgage products have shown far less month-to-month volatility compared with the previous two years. Two- and five-year fixed deals now tend to move in smaller increments, reflecting calmer expectations in wholesale funding markets.

Industry figures indicate that typical fixed mortgage rates are now clustered within a narrower range, reducing the risk of sudden affordability shocks for new borrowers. While rates remain elevated relative to historic lows, the pace of change has slowed considerably.

This stabilisation has allowed lenders to reprice products more consistently, improving market transparency.

Implications for First-Time Buyers

For first-time buyers, mortgage rate stability plays a critical role in affordability calculations. Predictable rates make it easier to assess monthly repayments, secure mortgage offers, and plan for associated costs such as deposits and legal fees.

Research published by UK Finance shows that first-time buyer activity is highly sensitive to rate volatility rather than rate level alone. When rates fluctuate sharply, buyers tend to delay decisions. When rates stabilise, transaction volumes often recover gradually, even if borrowing costs remain relatively high.

This dynamic helps explain why buyer confidence can improve without a return to historically low rates.

Effects on Existing Borrowers and Remortgaging

Mortgage stability also affects households coming to the end of fixed-rate deals. During periods of rapid rate increases, many borrowers faced sharp rises in monthly repayments. A more stable rate environment reduces uncertainty for households planning to remortgage or move onto new fixed terms.

Consumer finance analysis from the Money and Pensions Service suggests that borrowers are increasingly opting for shorter fixed terms, balancing repayment certainty with flexibility should rates fall in the future.

This behaviour reflects cautious household financial planning rather than renewed risk appetite.

Housing Market Activity and Lending Confidence

Stable mortgage pricing can also influence broader housing market activity. When borrowing conditions are predictable, buyers and sellers are more likely to align expectations, supporting transaction volumes.

Data from the Royal Institution of Chartered Surveyors indicates that market confidence tends to recover first among buyers, followed by sellers, once rate volatility subsides. This staged response can lead to gradual improvements in liquidity rather than rapid price growth.

As a result, stability supports market functioning without necessarily reigniting price inflation.

Regional and Income-Based Differences

The impact of mortgage rate stability is not uniform across the UK. Households in regions with lower average incomes or higher house price-to-earnings ratios remain more sensitive to borrowing costs.

Analysis by the Resolution Foundation highlights that mortgage affordability pressures are most acute among younger households and those with smaller deposits, even when rates stop rising. For these groups, stability reduces risk but does not eliminate access challenges.

This reinforces the importance of viewing mortgage conditions alongside income growth and housing supply.

Lender Behaviour and Product Design

Mortgage rate stability has also influenced lender behaviour. With reduced funding volatility, lenders have been able to expand product ranges, including longer fixed terms and more flexible repayment features.

Industry observers note that competition has shifted from headline rates to product features, such as overpayment flexibility and portability. This reflects a market adapting to stability rather than chasing rapid expansion.

For borrowers, this change places greater emphasis on product suitability rather than rate timing.

Stability Without a Return to the Past

While mortgage rates have stabilised, they are unlikely to return quickly to the exceptionally low levels seen before 2020. Policymakers and financial institutions have repeatedly signalled that borrowing costs are expected to remain higher than previous norms, reflecting structural changes in inflation and global finance.

For households, this means long-term planning is increasingly based on sustainable affordability rather than short-term rate expectations. Stability, rather than sharp declines, has become the key factor shaping decision-making.

A Calmer Environment for Informed Decisions

Mortgage rate stability provides households with a clearer framework for financial planning, even in a higher-rate environment. For homebuyers and borrowers alike, predictability reduces risk and supports more informed choices.

As lending conditions continue to normalise, the mortgage market’s role in shaping housing demand will depend less on rapid rate movements and more on income growth, housing availability, and broader economic confidence.

Read More on British Wire